Although there are very sound arguments against it, some customers are very adamant about wanting to own their technology. It's what they've always known and will always want to do. Security, AV, voice, data, video, etc. even though these technologies depreciate faster than a new car and equipment advances by the day, and the market is pointing towards X as a Service, you can't convince them all.

If ownership is inevitable, just know that using capital or cash is more expensive than a lease. Why?

As an example, let's consider a law firm that wants to buy (and own) a $12,000 Mitel phone system. They can write the upfront check for $12,000 or they can finance to own the solution for $252 per month over a 60 month $1 Buyout finance.

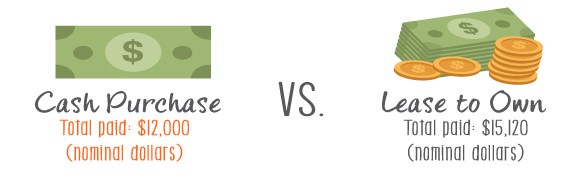

Make 60 payments of $252, totaling $15,120 or make a single payment of $12,000. The math doesn't lie, right? The upfront payment is obviously less than the total of the finance payments.

In terms of nominal dollars (the actual amount paid), YES.

BUT, in terms of the true cost and the actual value of those dollars when factoring in the Time Value of Money (TVM) and the accounting and tax implications that financial decision makers will evaluate, NO.

Sparing you the financial, tax, and accounting calculations, true cost is measured as After Tax Net Present Value (ATNPV). In this example, the ATNPV for the upfront purchase is about $8,800 and the ATNPV for the finance payments is about $6,300. In this illustration, the law firm would actually save about $2,500 by financing to own the system versus paying for it up front.

It is true that the total finance to own payments is almost always more than a single upfront cash payment. However, and more importantly, when measuring the real cost, the After Tax Net Present Value cost, financing to own is almost always less costly than a cash purchase if customers truly want to own whatever technology solution they are buying; security, AV, voice, video, data, IoT, etc.

If these concepts seem foreign to you, we recommend customers speak with a trusted financial accountant or CFO to help decide the best way to pay for an asset like technology equipment.

Want to understand the details of every payment option? Check out this guide that compares everything from cash to lease to rental for that new technology.