As a sales professional, the topic of rate is brought up pretty frequently when discussing payment options. Customers often have the preconception that all interest rates are the same. They seem to get sticker shock when they see "higher" rates when looking to obtain CPE technology solutions. It has become quite an issue, especially since some rates are at an all time low right now. So, how do we get our customers to look beyond the rate when buying IT equipment?

As a sales professional, the topic of rate is brought up pretty frequently when discussing payment options. Customers often have the preconception that all interest rates are the same. They seem to get sticker shock when they see "higher" rates when looking to obtain CPE technology solutions. It has become quite an issue, especially since some rates are at an all time low right now. So, how do we get our customers to look beyond the rate when buying IT equipment?

It's simple. Recommend a payment option that doesn't have an interest rate.

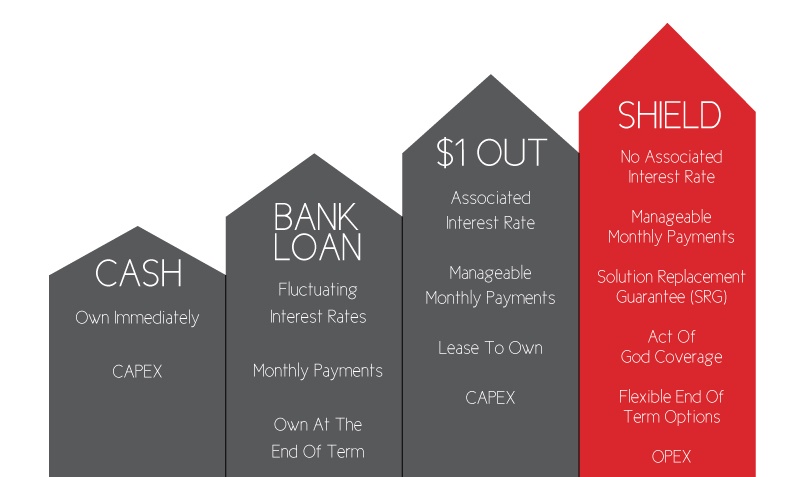

Contrary to what you may believe, not every financing option has an associated interest rate. With a termed rental like Frontier Shield, interest rate is nonexistent. Since Shield is a fee for use acquisition method (or, a rental), it offers the customer more value and flexibility than any other procurement method.

Think about it - how often has anyone considered interest rate when looking to rent an apartment? Probably never, as ownership is not the end goal. This is how it should be explained to your customers.

In today's environment where ownership is becoming less important and "X as a Service" payment options like Shield are more in demand, it is particularly important to decide if interest rate is even applicable to the sale. When comparing a rental to ownership or other procurement methods, it's like comparing apples to oranges.

Let's break down the facts:

- Termed rentals like Frontier Shield are not designed for ownership (no ownership = irrelevant interest rate)

- Shield adds value with benefits such as the Solution Replacement Guarantee (SRG), Act of God coverage, and flexible end of term options

- Any other financing option typically results in ownership, making the interest rate a bigger factor in the transaction (ownership = interest rate)

To put it simply, interest rate and Shield shouldn't even be in the same sentence.