Cadillac recently came out with a program where you can pay a monthly fee and choose from among a fleet of luxury vehicles to use. There is no hassle of depreciation, no worrying about mileage, no dealing with maintenance, and no mention of interest rate.

If payments of a financial obligation result in ownership of something (boat, car, home, etc.) there is a corresponding interest rate associated with those payments. However, if payments simply allow the use of something (Cadillac, apartment, rental car, office equipment, etc.) then they are just payments and there is no applicable interest rate.

When To Negate The Rate For CPE

The same concept about interest rate applies to an organization’s CPE technology. Yet day after day customers, account executives, or other CPE sales professionals will try to peg an interest rate to every payment option. Unfortunately, through habit, this is their go to indicator on how to determine value. While a $1 Buyout Lease absolutely does have an interest rate, the Frontier Shield termed rental payment does not.

In today’s environment where ownership is becoming less important and “XaaS” payment options like Shield are in more demand, it is particularly important to understand if interest rate is even one of the factors that is applicable to the payment option being considered.

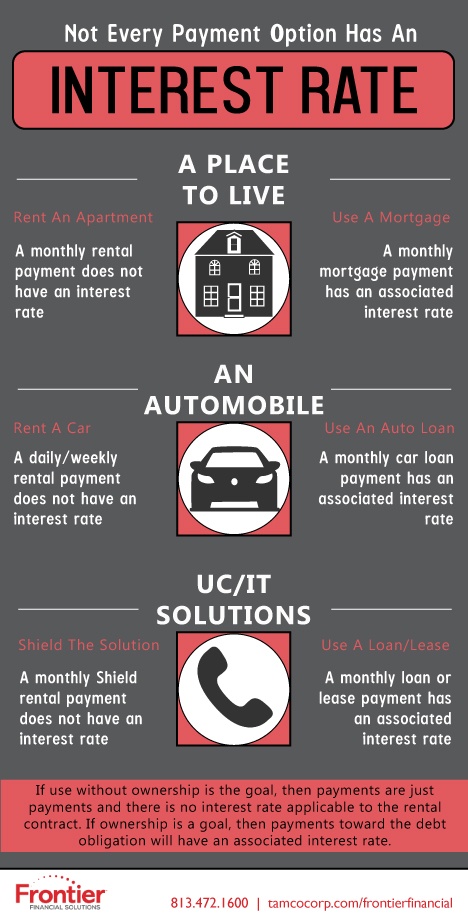

The infographic below highlights the reality of payment options that do and do not have interest rates.