Even if you think your customer may pay cash for their technology or CPE you still should utilize a pre-qualification tool. If you are curious as to why, it is quite simple. The more you know, the more control you can have in the sale.

Stop Selling Blind

Without knowing for sure if your prospect has the financial health or the capital to acquire the solution it is all just a shot in the dark. You are throwing things against the wall hoping it will stick. That is super dangerous in sales. Your time is precious. The last thing you need is to get to the end of a sale, think you are about to close when suddenly the customer informs you that the bank will not allow them to borrow the necessary funds. Now it is a fire drill that usually ends in no sale. If you pre-qualified your customer, you may have been able to see that they are credit-strapped and cash-less and no bank would lend to them. It would spark you to have a conversation about HOW TO BUY along with your WHAT TO BUY discussion.

Just a small disclaimer, not all pre-qualification tools are created equally. We are speaking in reference to the Frontier Financial pre-qualification tool and its abilities to provide important financial insight without alerting or touching the prospect's credit.

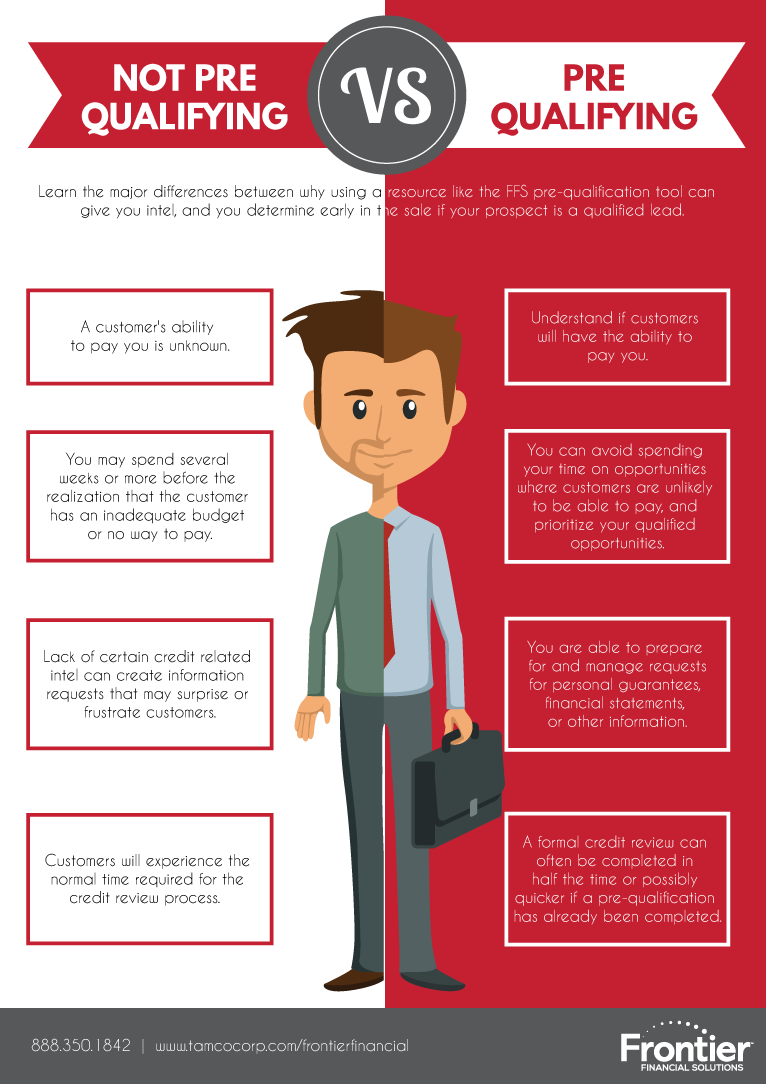

Pre-Qualifying VS Not Pre-Qualifying

This infographic is a good comparison to the importance of pre-qualifying your prospects versus what can happen if you do not pre-qualify them.

The Frontier Financial Solutions partnership goes above and beyond just a leasing company. Get connected with all of the tools and resources available to you for CPE sales. Download the FFS CPE Playbook to learn more.